Where will people keep money then

Top rich from ordinary people. Those who have money at the moment have only one question – where to put the money. The answer to this question is so long that the answer is the same, it is ‘savings certificate’. Because, as a safe investment, the highest profit is from matching savings certificates. Although it was late, the government started investing in the profits of savings certificates. Economists have long suggested lowering the rate of return on savings certificates. But the government was not listening to it for so long. Earlier, the Finance Minister had to face the heat of the ruling party MPs in the National Assembly by raising the source tax on savings certificates. So he was wasting his time to make a profit on savings certificates.

Because, savings certificates are very popular financial products for investment among all classes of people. There was a fear that his influence would spread from house to house if he touched it. That is why the tax identification number or TIN is made mandatory in the case of trading of savings certificates before handing over the profit. Besides, online system has also been introduced. Again, the maximum amount of savings certificates that can be bought in the name of single and joint, is also limited. After that the profit rate is reduced. Earlier, the highest interest rate on bank loans was fixed at 9 per cent from April last year. His push also comes at the interest rate of the deposit. At the end of last July, the average interest rate on deposits in the banking sector dropped to 4 percent.

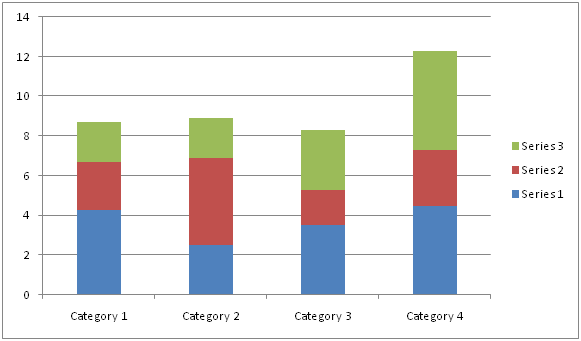

Interest rates on savings certificates are falling

This is also the average interest rate. In some places, the interest rate on bank deposits has come down to 2 percent. On the other hand, the average inflation in the country is around 5 and a half percent. Considering inflation, the common man actually gets profit by keeping money in the bank. Rather the value of money decreases. In this situation, last August, the central bank imposed an obligation to keep the interest rate on bank deposits above inflation. In Matadag, a large part of the small savings of the people of the country is either invested in banks or in savings certificates.

A large part of the country’s savings people live on the profit by keeping money in savings certificates. Especially retired people. On the one hand, the price of goods in the market is rising, on the other hand, the income is decreasing. Kareena has made many people jobless. A part of them has survived on the interest of savings money. The stock market is another medium for ordinary people to invest outside of banks and savings certificates. When interest in the bank goes down, when there are restrictions on the sale of savings certificates, the money goes

The bank’s interest rate is less than 5 percent, this time the profit rate of savings certificates has come down

In the stock market. In many ways. From individuals to organizations – everyone wants to get the highest profit against money. That’s why people cut where they see more profit. Where there is more profit, there is also a tendency to disobey laws and regulations. For this, the bank broke the law in the stock market and invested. Unipetu, Destiny, young people and the current Ehsan were formed by showing people more profit. Organization according to the group; Where by investing millions of rupees in the end it is common to disappear. People. For this, the government’s policy decision

Responsible, as well as management inefficiency. Suppose, for example, that the decision to reduce the profit rate of savings certificates. Savings certificates are the responsibility of the government. Therefore, the government is discouraging people from buying savings certificates through various policy decisions to reduce liability. The amount of savings that the government sets in the budget every year is much higher than the target set by the government at the end of the year. This greatly increases the government’s cost of paying interest. Again, due to the high interest on savings certificates, a large portion of the rich have invested in savings certificates anonymously. As a result, the benefits of high profits provided by the government through savings certificates are going to the pockets of the rich instead of to those who should actually go.